xoat.ru

Market

Does Xoom Accept Credit Card

You can pay for any Xoom transaction using a bank account, debit card, or credit card. For card payments in USD, you can use any Visa. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud. I was planning on using Xoom or Western Union etc, and while registering I noticed that they gave the option to send money using a credit card. can use your PayPal payment methods on Xoom. Upfront delivery times Send money to your contact's bank account, or their Visa or MasterCard debit card. No. When you use your debit or credit card, you won't be charged a cash advance fee for sending money for goods or services. receive it in Canada. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to get started. Step 4: Conveniently pay with PayPal, bank account, credit card, or debit card. Get the Xoom app. How to download. receive it in the Dominican Republic. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to. Step 4: Choose to pay with PayPal, bank account, credit card, or debit card. How to send money for cash pickup to India. You can pay for any Xoom transaction using a bank account, debit card, or credit card. For card payments in USD, you can use any Visa. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud. I was planning on using Xoom or Western Union etc, and while registering I noticed that they gave the option to send money using a credit card. can use your PayPal payment methods on Xoom. Upfront delivery times Send money to your contact's bank account, or their Visa or MasterCard debit card. No. When you use your debit or credit card, you won't be charged a cash advance fee for sending money for goods or services. receive it in Canada. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to get started. Step 4: Conveniently pay with PayPal, bank account, credit card, or debit card. Get the Xoom app. How to download. receive it in the Dominican Republic. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to. Step 4: Choose to pay with PayPal, bank account, credit card, or debit card. How to send money for cash pickup to India.

Step 4: Conveniently pay with a Paypal account, bank account, credit card, or debit card. We're here to help. Get human support when you really. receive it in Zambia. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to get started. You can pay using your bank account, debit card, or credit card. Need Help Yes, I accept. No, I decline. How much does Xoom really cost? ; Credit or debit card transaction fee, Minimum of $, but can rise substantially depending on currency and transfer amount. Step 3:Provide your recipient's mobile wallet account. Step 4:Conveniently pay with a PayPal account, bank account, credit card, or debit card. Zoom accepts Visa, Mastercard, Discover, JCB, and American Express for credit card payments. You can update your credit card information at any time through. Xoom customers can send money online via any computer, tablet, or phone with a credit card, debit card, or bank account. Xoom's money transfer service is. Step 2: Choose Pix as the receiving option. Step 3: Enter your contact's pix key on our secure page. Step 4: Conveniently pay with PayPal, bank account, credit. VISA, Mastercard, Discover, AMEX or eCheck. Monday - Friday a.m. - p.m. (ET) Saturday a.m. What are Xoom's sending limits? · Driver's license, passport, or Green Card to verify your identity · Utility bill or another proof of address, either a bank. For card payments in USD, you can use any Visa, MasterCard, and Discover credit card and debit card issued in the US. receive it in India. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to get started. Xoom is a PayPal service, so if you already have a PayPal account there's no need to register with Xoom before you can begin making payments. You'll be able to. Senders can fund their money transfer with a credit card, debit card or bank account. Xoom partners with select money transfer partners to provide a. Customers may use their debit or credit card for in-store transactions. How long do money transfers take? A money transfer can take a few minutes or several. receive it in Kenya. Step 3: Conveniently pay with with PayPal, bank account, credit card, or debit card and you're done! Sign up now to get started. Pay any other Venmo or PayPal user with the flexibility of Amex. · There's no standard credit card fee. · Send money from the Amex App or directly from the Venmo. You can also store credit cards, debit cards, transit passes and more in Google Pay for quick, easy access right from your phone. With security built into. You can fund and pay for your money transfers using a bank account, a PayPal account, a debit card, or a credit card. The transaction fee you pay will vary. When sending money online with Xoom, you can pay for the transfer using a bank account, credit card, or debit card. Because Xoom is owned by PayPal, users also.

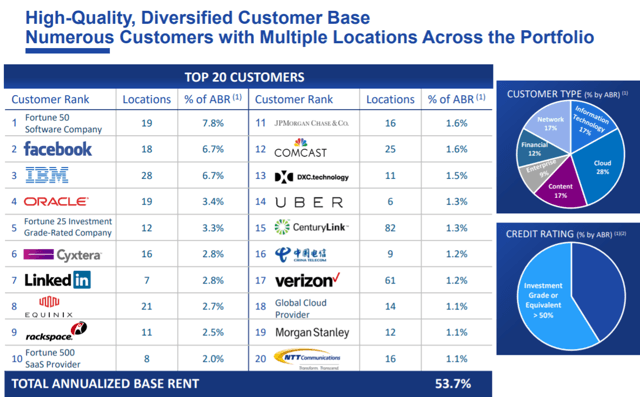

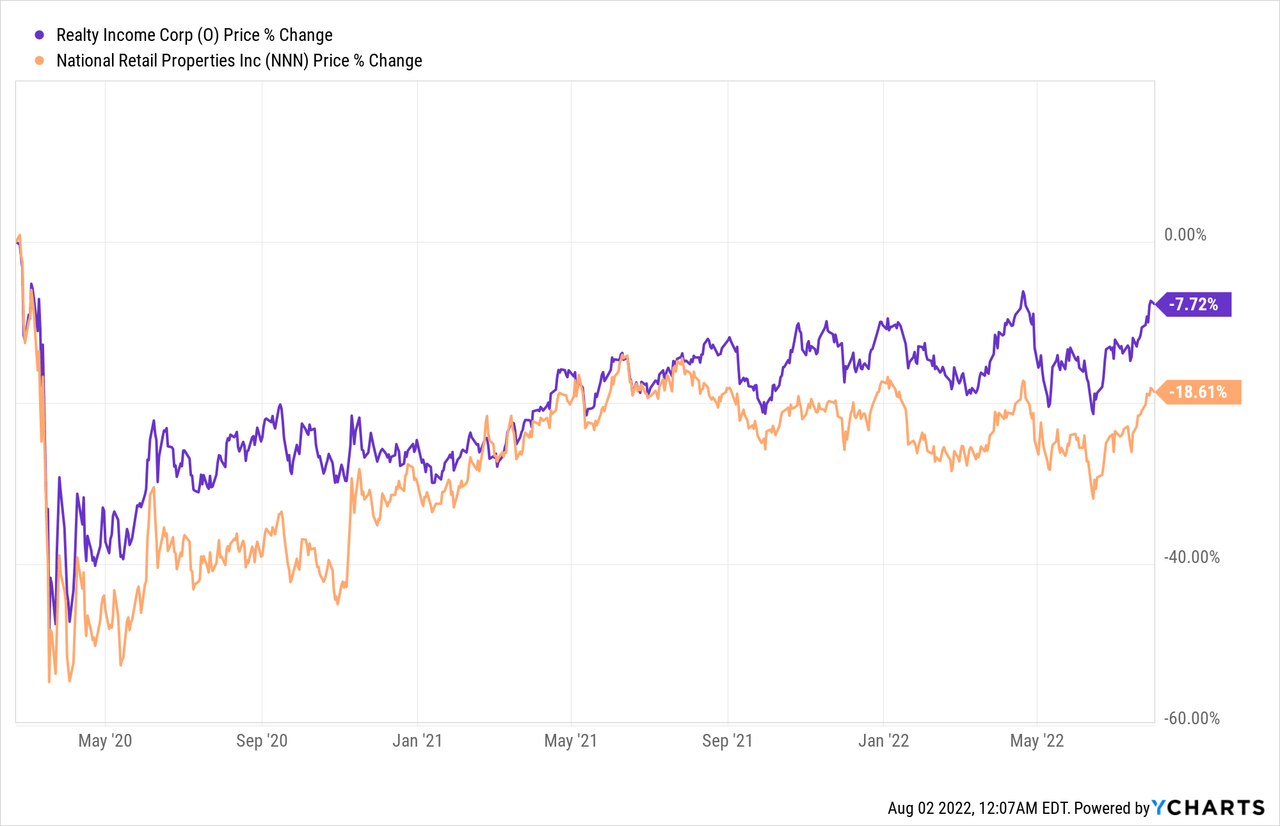

Reit Picks

Seeking Alpha has the best in-depth content on REIT stock and ETF investing and analysis. Come find the best information from our quality contributors. Prologis has a dividend yield of %. The REIT beat on 3Q18 estimates, bringing in rental revenues of $ million versus $ million in the same quarter. What are the largest REIT ETFs? · Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. Finding REITs. You can use the free, easy-to-use screener at xoat.ru to find REITs. Start by going to the FINVIZ homepage (xoat.ru) and then selecting. Once again, Vanguard brings to market the most economical investment vehicle. You can't find a better way to invest in the U.S. REIT market than through VNQ. Real estate offerings like REITs with Streitwise are open to all investors and are considered one of the best ways to hedge for inflation. FULL. As of [xoat.ru_weekends]. A real estate investment trust (REIT) is a company that owns, operates or finances income-generating real estate across a range. Green Street is the premier provider of research on REIT stocks and REIT valuation driven by our independent perspective, trusted proprietary data. Here are some of the top residential REIT stocks for plus steps on how to invest them. Compare companies and invest today. Seeking Alpha has the best in-depth content on REIT stock and ETF investing and analysis. Come find the best information from our quality contributors. Prologis has a dividend yield of %. The REIT beat on 3Q18 estimates, bringing in rental revenues of $ million versus $ million in the same quarter. What are the largest REIT ETFs? · Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. Finding REITs. You can use the free, easy-to-use screener at xoat.ru to find REITs. Start by going to the FINVIZ homepage (xoat.ru) and then selecting. Once again, Vanguard brings to market the most economical investment vehicle. You can't find a better way to invest in the U.S. REIT market than through VNQ. Real estate offerings like REITs with Streitwise are open to all investors and are considered one of the best ways to hedge for inflation. FULL. As of [xoat.ru_weekends]. A real estate investment trust (REIT) is a company that owns, operates or finances income-generating real estate across a range. Green Street is the premier provider of research on REIT stocks and REIT valuation driven by our independent perspective, trusted proprietary data. Here are some of the top residential REIT stocks for plus steps on how to invest them. Compare companies and invest today.

Best REIT ETFs to Buy. Real estate investment trust, or REIT, ETFs are a great choice for investors looking for high dividend income and good growth potential. For 60 years, Nareit has led the U.S. REIT industry by ensuring its members' best interests are promoted by providing unparalleled advocacy, investor outreach. A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns—and in most cases operates—income-producing real. Best time to invest is when seller is extremely motivated to sell. I love death and divorces. Both those situations create ultimate. A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns—and in most cases operates—income-producing real. stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. Zacks • 10 days ago. PDM. +. Simon Property Group · Simon Property Group (· the shopping mall REITs and one of the · largest retail REITs in general. Its size and · management strategy. The information contained within this website is, to the best of our knowledge, considered accurate as of the date it was posted, but it has not been audited or. As a result, online real estate investing has the potential to offer the best of both worlds to many investors. As with all investments, important factors like. Based on 32 Wall Street analysts offering 12 month price targets to REIT holdings in the last 3 months. The average price target is $ with a high forecast. REIT ETFs offer investors excellent income, top quality management and valuable diversification. The Best REIT for Industrial Properties. One of the best opportunities in real estate right now is in industrial REITs. These REITs own the warehouses and. iShares UK Property UCITS ETF. One of the few UK REIT ETFs, this fund seeks to track the performance of an index composed of UK-listed real estate companies and. › Best Financials › Best Real Estate › Best Communications › Best Consumer Our picks from the + dividend stocks paying a monthly dividend. 10 Best REITS to Invest in for Reliable Income in · 1. Crown Castle Inc. Share price: $ Market cap: $B · 2. EPR Properties. Share price: $ Top 6 REITs for · Realty Income Corporation · 2. VICI Properties Inc · 3. Agree Realty Corporation · 4. Prologis, Inc · 5. Alexandria Real Estate Equities. Investors Have Their Pick of High-Yield Options. M any institutional investors,high-net-worth individuals and investment advisers have lately sought bigger. REIT Outlook: Pro Forecasts, Strategies and Picks for [Chills ft Kenny Loh]. The Financial Coconut Podcast. Oct 50 min 35 sec. Are you feeling. Real Estate: Making the REIT Picks. David Lee of T. Rowe Price Real Estate Fund tells how he's outperforming rivalsand the stock marketand what property.

Gold Price Vs Inflation Chart

In this chart, the real interest rate is calculated by the year US Treasury bond yield minus the forward five-year expected inflation rate in the US. 1. When. While their price movements are often influenced by many of the same factors, namely inflation and general sentiment towards other investments, their prices don. While it fluctuates some over time, like any other commodity, an ounce of gold increased in value from to by $1, Going from $ to $1, The CPI-U (consumer price index) is the broadest measure of consumer price inflation for goods and services published by the Bureau of Labor Statistics (BLS). Gold Prices - Year Historical Chart. Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to Chart 1: Gold price adjusted for inflation (calculated as the ratio of the nominal London morning fixing price of gold to the CPI index) from to Gold. Gold hit an all-time high nominal price in April of amid rising asset prices across the board, but gold's inflation-adjusted high was still seen in inflation-adjusted gold price chart using the CPI formula. For easy reference, this page also contains a simple table that provides gold's price change and. Historically, Inflation Adjusted Gold Price, Adjusted to Today's Dollar reached a record high of and a record low of , the median value is In this chart, the real interest rate is calculated by the year US Treasury bond yield minus the forward five-year expected inflation rate in the US. 1. When. While their price movements are often influenced by many of the same factors, namely inflation and general sentiment towards other investments, their prices don. While it fluctuates some over time, like any other commodity, an ounce of gold increased in value from to by $1, Going from $ to $1, The CPI-U (consumer price index) is the broadest measure of consumer price inflation for goods and services published by the Bureau of Labor Statistics (BLS). Gold Prices - Year Historical Chart. Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to Chart 1: Gold price adjusted for inflation (calculated as the ratio of the nominal London morning fixing price of gold to the CPI index) from to Gold. Gold hit an all-time high nominal price in April of amid rising asset prices across the board, but gold's inflation-adjusted high was still seen in inflation-adjusted gold price chart using the CPI formula. For easy reference, this page also contains a simple table that provides gold's price change and. Historically, Inflation Adjusted Gold Price, Adjusted to Today's Dollar reached a record high of and a record low of , the median value is

9 economic data series with tags: Price Index, Inflation, Gold. FRED: Download, graph, and track economic data. inflation, and market trends. Dive into our interactive charts, tables and calendars to understand how historical gold price trends can offer insights for. The Russia-Ukraine war, US Fed rate increase, and inflation have played a role in gold rates increasing. The increase in the demand for gold has seen the. and the Iranian Revolution caused unanticipated inflation, nominal interest rates did not rise fast enough to keep up with the rise in the inflation rate. For protection against inflation, demand for gold rises, providing support for gold prices. Real interest rate (i.e., nominal rate less inflation) also weighs. We can observe high positive correlation between inflation and gold price. Please take a look at the chart below to see how closely two values are tied. However, the “real” rate (prevailing interest rate minus inflation) is more important than the nominal rate itself. Stock Markets - Gold and the stock market. inflation-adjusted gold price chart using the CPI formula. For easy reference, this page also contains a simple table that provides gold's price change and. Commodity prices are reflecting this, as are shipping rates and business inventory data. In addition, the massive increase in global government debt as well as. Average. Price. Year. Average. Price. Year. Average. Price. Year. Average. Price A two-tiered pricing system was created in , and the market price for. Inflation Adjusted Gold Price Source: xoat.ru View other gold price history charts including 3 months, 6 months, 1 year, 5 years and 10 years. inflation gauge, and the second estimates of Q2 GDP figures. Traders are currently pricing in a 71% probability of a 25 bps cut and a 29% chance of a more. In other words, when investors assume that the Federal Reserve will continue raising interest rates aggressively and will be successful in lowering inflation. Because gold is generally dollar-denominated, a stronger U.S. dollar tends to drive gold prices lower, and vice versa. Real and expected inflation rates also. The real yield in the chart above is calculated by subtracting the Year expected Inflation Rate from the Year Treasury Constant Maturity Rate. According. Stay informed with real-time charts of international precious metal prices. Monitor spot prices for Gold in USD, GBP, and EUR. Access live updates here >>. There's no direct correlation between inflation and the price of gold. In fact, gold can act as a hedge against inflation. Rate Inflation Calculator and Backward Flat Rate Inflation Calculator that and stocking up on finite resources that could retain value, such as gold. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of. inflation” have historically occurred soon after. When this phenomena begins, inflation spirals out of control and collapses the economy into a devastating.

Best Google App To Earn Money

Answer Surveys & Earn Money · Google · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and Reviews · App Privacy. KashKick. I think the best game app to win real money is KashKick. KashKick allows you to earn $ or more by playing popular mobile games like. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. Again, advertising through mobile apps can be a great way to make money from app stores like Google Play. 2. Cost Per Mille (CPM). You will get paid. Answer quick surveys and earn Google Play credit with Google Opinion Rewards, an app created by the Google Surveys team. Getting started is easy. If you'd like to gain rewards for doing surveys, you should try the app Google Opinion Rewards. Simply download the app and answer some questions about yourself. Tap into a range of tools to make more money · AdMob · Google Ads API · Interactive Media Ads · Google Pay · Google Play Billing. Want to get apps, games, movies, TV shows, and books for free on Google Play? Then it's time to use the Google Opinion Rewards app, a mobile survey tool. Your opinion is valuable. Earn rewards for helping us improve our products and services. Surveys App. Download on the App Store · Get it on Google Play. Your. Answer Surveys & Earn Money · Google · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and Reviews · App Privacy. KashKick. I think the best game app to win real money is KashKick. KashKick allows you to earn $ or more by playing popular mobile games like. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. Again, advertising through mobile apps can be a great way to make money from app stores like Google Play. 2. Cost Per Mille (CPM). You will get paid. Answer quick surveys and earn Google Play credit with Google Opinion Rewards, an app created by the Google Surveys team. Getting started is easy. If you'd like to gain rewards for doing surveys, you should try the app Google Opinion Rewards. Simply download the app and answer some questions about yourself. Tap into a range of tools to make more money · AdMob · Google Ads API · Interactive Media Ads · Google Pay · Google Play Billing. Want to get apps, games, movies, TV shows, and books for free on Google Play? Then it's time to use the Google Opinion Rewards app, a mobile survey tool. Your opinion is valuable. Earn rewards for helping us improve our products and services. Surveys App. Download on the App Store · Get it on Google Play. Your.

15 Best Money-Making Apps. Here are the top apps to make money in Branded Surveys; HeyPiggy; Freecash; Swagbucks; Survey Junkie; DoorDash. AdSense makes it easy to earn money from your content, whether you're an independent creator or a larger company. You're always in control. Shop, snap and play to earn free gift cards with Fetch Download on the Apple App Store Download on the Google Play Store Over 5 million 5 stars. Google AdSense is an accessible, affordable, and efficient way for a website owner to start earning ad revenue. There is a long list of factors that could. Taskmate, Google Opinion Rewards, Google Ads, and YouTube. These apps offer various income opportunities, from completing tasks to sharing. Taskmate, Google Opinion Rewards, Google Ads, and YouTube. These apps offer various income opportunities, from completing tasks to sharing. For mobiles, the most famous platforms are Google Play Store and App Store, which allow Android and iOS apps featured in them, respectively. Android apps. Online earning, nowadays become usual. Everyone is earning money by various mode available online. Various applications are available for. The Google Play Store is a great platform to expose apps to the world. One can also start earning in-app purchases or earn money through sponsorship. A. As of August , there are a total of 4,, apps available across Google Play and the Apple App Store. best ways to generate a healthy profit using this. Swagbucks/MyPoints/Inboxdollars [there are other activities you can do to earn such as the polls, offers, Swagbucks Daily Trivia Live, etc.]. A good App that is much helpful when you get paid less amounts but have patience you will eventually get more surveys and earn more opinion rewards. The. With Google Opinion Rewards, you'll take surveys that are run by market researchers. Survey frequency may vary, and you don't have to answer every survey. Displaying in-app advertisements is another popular monetization strategy. This is one of the easiest ways to start making money from an app right away. Unless. Utilize Admob's mobile app monetization technology to generate revenue through in-app ads & discover other actionable insights to help your app grow. Short-Term Tasks Sites · xoat.ru Ibotta is a cash-back app that allows users to earn money by making purchases at participating stores and scanning their. This guide can help you avoid app store rejection Laws and regulations every app developer should know. Read also. Best Practices for iOS and Android App. Google takes 30% of the revenue made on the Android app and gives the rest 70% to the developers. Q. Do apps make a lot of money? A. It depends. But on a very. Best Overall: Upwork Upwork's simplicity, streamlined communication and potential for freelancers to earn more over time make it the best money-making app. The web's #1 top app for taking surveys, watching videos, and playing games for cash online is Swagbucks.

Do Credit Cards Help You Build Credit

Another potential downside of having a large number of cards is that it can make you look risky to lenders and lower your credit score. Even if you have them. Simply having it appear on your report can be enough to improve or establish credit. The trick is to make sure the person who owns the card pays it as agreed. There are a variety of ways to build credit with credit cards: consistently using less than your credit limit, using your card to make regular purchases. If your credit rating is lacking a co-signer could help you get a loan, and help build your credit rating. A co-signer will enter into the loan agreement along. 5. An increased credit limit on cards The higher your credit score, the more willing a credit card company will be to give you a higher spending limit on your. How to Build Your Credit from Scratch - Credit Cards Can Help · At-A-Glance · Best Credit Cards to Build Credit · Build Credit With a Loan in Your Own Name. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. A good credit score could improve your chances of being accepted for credit in future. · When using a credit card, always make payments on time and minimise what. The Discover it® Secured Card can help you build credit with responsible use2, like making your payments on time and in full each month. Payment history is. Another potential downside of having a large number of cards is that it can make you look risky to lenders and lower your credit score. Even if you have them. Simply having it appear on your report can be enough to improve or establish credit. The trick is to make sure the person who owns the card pays it as agreed. There are a variety of ways to build credit with credit cards: consistently using less than your credit limit, using your card to make regular purchases. If your credit rating is lacking a co-signer could help you get a loan, and help build your credit rating. A co-signer will enter into the loan agreement along. 5. An increased credit limit on cards The higher your credit score, the more willing a credit card company will be to give you a higher spending limit on your. How to Build Your Credit from Scratch - Credit Cards Can Help · At-A-Glance · Best Credit Cards to Build Credit · Build Credit With a Loan in Your Own Name. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. A good credit score could improve your chances of being accepted for credit in future. · When using a credit card, always make payments on time and minimise what. The Discover it® Secured Card can help you build credit with responsible use2, like making your payments on time and in full each month. Payment history is.

A secured credit card could also be a good way to establish or reestablish your credit. With a secured credit card, you deposit the amount of your credit limit. To build credit with a credit card, you need to actually have a credit card. Trouble is, credit card companies prefer it when their new customers come to them. Whether you're trying to improve your credit scores or start building a credit history, a secured credit card can be a great option. Because they are backed by. A credit card can help you build credit 1, make convenient payments and meet everyday expenses in your life. A secured credit card can help build credit history, as the bank reports your regular payments to credit bureaus. As you prove your reliability, you may then be. Grow Credit builds credit factors that make up 90% of your FICO Score5No hard credit inquiry required. 35%. Payment History. Make on-time payments in full every. A credit card is a great way to start building up your credit, which is especially important for international students who do not have credit history in the. When you open a new credit card, you have an opportunity to reduce your credit utilization ratio — since your credit line is being increased — and improve your. Starter credit cards are typically meant for people with little to no credit history looking to build a credit profile that may help secure future loans. Opening a new credit card may temporarily hurt your credit score, but could help you improve your score in the long run. We'll explain how. 1. Understand credit-scoring factors. Credit can get complicated. · 2. Develop and maintain good credit habits · 3. Apply for a credit card · 4. Try a secured. Discover reports your credit history to the 3 major credit bureaus, and every Discover® Cardmember has access to their Credit Scorecard to help monitor their. You can build credit in any number of ways, including opening a credit card, paying eligible bills on time with *Experian Boost™ and getting credit for monthly. Secured credit card can be a great option for building credit. Many don't have annual fees and even let you earn rewards. green-ribbon-image. Winner. A credit card can help you build credit because most major credit bureaus report your account and activity to all three credit bureaus. with no annual fees. The Chime Credit Builder Credit Card can help you build credit with no annual fees, no interest1, no large security deposits², and no. Knowing the facts about credit cards can help you avoid financial pitfalls and build your credit history. Discover 7 facts about credit cards from Better. Just use your card, even at the ATM, to build credit with everyday purchases, earn points, and more. Building credit isn't hard once you know how to get started. Learn more about how credit cards can help you build or re-build yours. Opting for a secured card that reports your payment history to ideally all three of the major credit bureaus will help you build your credit score. “Regardless.

National Retail Properties Stock Price

Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Company Profile. NNN REIT Inc is a real estate investment trust that invests in and develops properties throughout the United States. The company generates. NNN REIT Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · NNN Overview · Key Data · Performance · Analyst Ratings. Sell; Under; Hold. The latest closing stock price for NNN REIT as of September 09, is The all-time high NNN REIT stock closing price was on September 09, NNN REIT, Inc. is a fully integrated real estate investment trust (REIT). NNN's assets include real estate assets, mortgages and notes receivable, and. Based on 9 Wall Street analysts offering 12 month price targets for National Retail Properties in the last 3 months. The average price target is $ with a. What was National Retail Properties's price range in the past 12 months? National Retail Properties lowest stock price was $ and its highest was $ in. Find the latest National Retail Properties, Inc. (NNN) stock quote, history, news and other vital information to help you with your stock trading and. NNN REIT Inc News & Analysis · National Retail stock hits week high at $ amid robust growth · Nnn REIT executive sells $, in company stock · Nnn. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Company Profile. NNN REIT Inc is a real estate investment trust that invests in and develops properties throughout the United States. The company generates. NNN REIT Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · NNN Overview · Key Data · Performance · Analyst Ratings. Sell; Under; Hold. The latest closing stock price for NNN REIT as of September 09, is The all-time high NNN REIT stock closing price was on September 09, NNN REIT, Inc. is a fully integrated real estate investment trust (REIT). NNN's assets include real estate assets, mortgages and notes receivable, and. Based on 9 Wall Street analysts offering 12 month price targets for National Retail Properties in the last 3 months. The average price target is $ with a. What was National Retail Properties's price range in the past 12 months? National Retail Properties lowest stock price was $ and its highest was $ in. Find the latest National Retail Properties, Inc. (NNN) stock quote, history, news and other vital information to help you with your stock trading and. NNN REIT Inc News & Analysis · National Retail stock hits week high at $ amid robust growth · Nnn REIT executive sells $, in company stock · Nnn.

Stock Quote September 13, Minimum 20 minute delay. Change. $ %. Volume. ,

National Retail Properties ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. b ; Total Shares. m. Key Turning Points ; 1st Resistance Point, ; Last Price, ; 1st Support Level, ; 2nd Support Level, ; 3rd Support Level, Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. Looking to buy National Retail Properties Stock? View today's NNN stock price, trade commission-free, and discuss NNN stock updates with the investor. This Nearly 5%-Yielding Passive Income Stock Just Raised Its Dividend for the 35th Year in a Row. NNN REIT is among the dividend-paying elite. In depth view into NNN (NNN REIT) stock including the latest price, news, dividend history, earnings information and financials. NNN REIT remains a 'buy' for stability-seeking investors due to its strong track record and attractive risk-to-reward ratio, despite limited upside potential. Wall Street analysts forecast NNN stock price to rise over the next 12 months. According to Wall Street. Stock analysis for NNN REIT Inc (NNN:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. About NNN REIT, Inc. NNN REIT, Inc. is a real estate investment trust, which engages in investing in properties subject to long-term net leases. It acquires. NNN REIT invests primarily in high-quality retail properties subject generally to long-term, net leases. As of December 31, , the company owned 3, Discover real-time NNN REIT, Inc. Common Stock (NNN) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Total Shareholder Return Comparison For Periods Ending June 30, Total Return comprised of stock price appreciation plus dividends paid. * NNN is a. [9/25/] National Retail Properties (NNN) Stock Price Forecast: AI Forecasts NNN Stock Price To Be Around $ In A Month (Up 1%). Chance of. View NNN REIT, Inc. NNN stock quote prices, financial information, real-time forecasts, and company news from CNN. National Retail Properties stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. NNN REIT invests primarily in high-quality retail properties subject generally to long-term, net leases. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share). Data Disclaimer: The Nasdaq Indices. Stock Range ; Today's Range. Low: ; 52 Week Range. Low: ; Liquidity liquidity High. Low. NNN Stock Price Chart ; Last Close Price. $ Week Range ; Dividend Yield. %. PE Ratio ; Revenue TTM. $M · Net Income TTM ; TTM Total Return.

Best Business Lines

Learn about the factors to consider when choosing a business line of credit, compare current rates, and get tips for applying for one in Canada. Best Uses of Credit Lines by Small Businesses · Equipment Expenses: You can use your business line of credit to repair or purchase new equipment. · Cash Flow Gaps. PNC Bank offers business lines of credit to help your small business access capital and prepare for changing needs. Secured and unsecured options available. Entering new markets? Expanding a product line? An asset-based line of credit supported by your accounts receivable and/or inventory may be a good option. Alpine Bank offers some of the best small business line of credit choices in CO. Read more below. Ready Reserve Line of Credit. With a Ready Reserve tied to. Credit cards typically come with a physical card; you can make purchases up to a credit limit, and you need to make minimum monthly payments. Get the best of. Best Business Lines of Credit in Amex, Bluevine, and PNC offer the best business lines of credit. So how exactly does a business line of credit differ from standard loans for small businesses? And what makes a business line of credit a better option in many. You can use a line of credit for business operations, equipment repairs, and other needs. Apply for a small business line of credit with Fifth Third Bank. Learn about the factors to consider when choosing a business line of credit, compare current rates, and get tips for applying for one in Canada. Best Uses of Credit Lines by Small Businesses · Equipment Expenses: You can use your business line of credit to repair or purchase new equipment. · Cash Flow Gaps. PNC Bank offers business lines of credit to help your small business access capital and prepare for changing needs. Secured and unsecured options available. Entering new markets? Expanding a product line? An asset-based line of credit supported by your accounts receivable and/or inventory may be a good option. Alpine Bank offers some of the best small business line of credit choices in CO. Read more below. Ready Reserve Line of Credit. With a Ready Reserve tied to. Credit cards typically come with a physical card; you can make purchases up to a credit limit, and you need to make minimum monthly payments. Get the best of. Best Business Lines of Credit in Amex, Bluevine, and PNC offer the best business lines of credit. So how exactly does a business line of credit differ from standard loans for small businesses? And what makes a business line of credit a better option in many. You can use a line of credit for business operations, equipment repairs, and other needs. Apply for a small business line of credit with Fifth Third Bank.

Lower interest and lower fees: For some business expenses and situations, it's often better to use a business line of credit than a business credit card. A business line of credit can be a good idea, allowing you to borrow only what you need for short-term expenses and pay interest only on that sum. For some businesses, a business line of credit is the best option. A business line of credit will let you borrow up to a specific amount and pay interest only. You don't always know when an exciting new business opportunity is going to fall into your lap, but when it does, it's best to be prepared with quick access to. Below, compare the best small-business loans, including bank and SBA loans, business lines of credit, term loans and equipment financing. No one knows your business better than you do. Our fixed- and variable-rate credit line options can help you grow your business, cover short-term cash flow. Or avoid tying up assets and opt for an operating line of credit. Our business lenders will work with you to find the best solution for your business. Operating. A business line of credit is a great way for growing businesses to satisfy its cash flow needs. Businesses can use funds for a variety of purposes, allowing you. You don't always know when an exciting new business opportunity is going to fall into your lap, but when it does, it's best to be prepared with quick access to. A Business Line of Credit provides cash flow flexibility. Used to fund business expenses like payroll, advertising, or inventory purchases. Get up tp $K. Need cash without collateral? Consider an unsecured business line of credit from Bank of America to help bridge the gap between payables and receivables. The top line is a pure gross sales number showing how much revenue the company brought in for a given period. As such, it does not subtract expenses, such as. Financing Solutions, a BBB A+ and 5 star accredited company, provides a business line of credit to businesses, nonprofits, churches, and Fedex ISPs. Our credit. Credibly business experts are standing by to help you understand your financing options, get you the best Are business lines of credit secured or unsecured? The Cost of Hiring · Raise vs. Bonus · When to Outsource · Employee Health Insurance · Best Health Insurance for Small Business Owners · QSEHRA Health Coverage. A line of credit gives your business access to a set amount of financing that you can access as needed for short-term business needs — restocking products. A line of credit can help. The best part? You only pay interest on what you actually borrow. It's a nice cushion for tougher months and a springboard for new. They're good fits for small businesses that want to streamline cash flow and get funds quickly. Minimum Eligibility Requirements. If you're seeking less than. Additional information related to applying for credit can be found at our Small Business Resource Center: Developing a good credit application · Five steps to. If you need funds for your business quickly, OnDeck could be a good option. Its business lines of credit range from $6, to $, with one-year repayment.

The Dow Jones Live

Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. 57 minutes ago. Live Price of Dow Jones Futures. Dow Jones Futures Live Chart, Intraday & Historical Chart. Dow Jones Futures Buy & Sell Signal and News & Videos, Dow Jones. Check out the latest Dow Jones Averages (I:DJI) stock quote and chart. View real-time stock prices & the company's financial overview to help with your. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Find the latest Dow Jones Industrial Average (^DJI) stock quote, history, news and other vital information to help you with your stock trading and. Dow Jones Industrial Average (DJI) ; Prev. Close: 41, ; Open: 41, ; 1-Year Change: % ; Volume: ,, ; Average Vol. (3m): ,, Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. 57 minutes ago. Live Price of Dow Jones Futures. Dow Jones Futures Live Chart, Intraday & Historical Chart. Dow Jones Futures Buy & Sell Signal and News & Videos, Dow Jones. Check out the latest Dow Jones Averages (I:DJI) stock quote and chart. View real-time stock prices & the company's financial overview to help with your. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Find the latest Dow Jones Industrial Average (^DJI) stock quote, history, news and other vital information to help you with your stock trading and. Dow Jones Industrial Average (DJI) ; Prev. Close: 41, ; Open: 41, ; 1-Year Change: % ; Volume: ,, ; Average Vol. (3m): ,,

Dow Jones LIVE CHART. show previous day · GO IN-DEPTH ON Dow Jones · Dow Jones Tick History · Notice. Dow Jones 30 Index Live Chart, US 30 Real Time Chart, US30USD chart by TradingView, Dow Jones Industrial Average 30 Index Technical Analysis. Live Price of Dow Jones. Dow Jones Live Chart, Dow Jones Intraday & Historical Live Chart. Dow Jones Buy Sell Signal, Dow Jones News, Dow Jones Videos. Dow Futures Index Share Price Live - Get Real-time prices of Dow Futures indices, including performance and market data on xoat.ru 40 minutes ago. Dow Jones has grown to be a worldwide news and information powerhouse, with prestigious brands including The Wall Street Journal, Dow Jones Newswires, Factiva. it. Real-time charts. Trading signals. Three types of alert. Reuters news feed. Open demo account · Or trade now with a live account. Wall Street news and. Dow Jones Futures 41, (%). Dow Jones Futures Graph | As on 17 Sep, | IST. ADVANCE / DECLINE. Nasdaq 17, (%). Dow Index Share Price Live - Get Real-time prices of Dow indices, including performance and market data on xoat.ru Get Live Dow Futures Rates. Dow Jones Futures Live & updated. Other Stock Market Futures Live. Chart of Dow Jones Industrial Average Index. Get Dow Jones Industrial Average .DJI:Dow Jones Global Indexes) real-time stock quotes, news, price and financial information from CNBC. Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. DOW JONES INDUSTRIAL AVERAGE, 41,, (%). S&P INDEX, 5, update or delete your personal information, or submit a request to. Technical analysis and Quotes on Moneycontrol. Also we provide data about Dow Jones Futures Live, Futures, Stock/Share, Market/Exchange and much more on. View the full Dow Jones Industrial Average (DJIA) index overview WSJ Live · Commercial Partnerships. Customer Service. Customer Center · Contact Us. Live Dow Jones Futures prices and pre-market data including Dow Futures stock market news, charts, analysis and more Dow Jones Futures coverage. Free live Dow Jones Chart - Our popular DJIA index live chart page featuring our real time stock chart, news and quotes. Prices for United States Stock Market Index (US30) including live quotes, historical charts and news. United States Stock Market Index (US30) was last. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. View live Dow Jones Industrial Average Index chart to track latest price changes. DJ:DJI trade ideas, forecasts and market news are at your disposal as.

If I Am Married Filing Separate

Yes. If you are married but unable to file a joint return because of domestic abuse, you can file as married-filing-separately and claim the premium tax. Married filing jointly means each spouse is liable for all income tax obligations, including the complete income tax bill, any interest, and potential. Generally no. Married taxpayers are required to file a joint tax return in order to qualify for premium tax credits. and their federal filing status, if they have one. filing status “married filing jointly” or “married filing separately” on their South Carolina and. For tax purposes, whether a person is classified as married is based on the last day of the tax year, which means that a person married on the last day of the. Married filing separately (MFS): a personal income tax filing status used by a couple that is married at the end of the year and chooses to file separate tax. People who use the “married filing separately” status are not eligible to receive premium tax credits (and also cannot claim certain other tax breaks, such as. The calculator does not compare the taxes a married couple would pay filing jointly with what they would pay if married and filing separately. have served at. If both you and your spouse have income, you should usually figure your tax on both a joint return and separate returns (using the filing status of married. Yes. If you are married but unable to file a joint return because of domestic abuse, you can file as married-filing-separately and claim the premium tax. Married filing jointly means each spouse is liable for all income tax obligations, including the complete income tax bill, any interest, and potential. Generally no. Married taxpayers are required to file a joint tax return in order to qualify for premium tax credits. and their federal filing status, if they have one. filing status “married filing jointly” or “married filing separately” on their South Carolina and. For tax purposes, whether a person is classified as married is based on the last day of the tax year, which means that a person married on the last day of the. Married filing separately (MFS): a personal income tax filing status used by a couple that is married at the end of the year and chooses to file separate tax. People who use the “married filing separately” status are not eligible to receive premium tax credits (and also cannot claim certain other tax breaks, such as. The calculator does not compare the taxes a married couple would pay filing jointly with what they would pay if married and filing separately. have served at. If both you and your spouse have income, you should usually figure your tax on both a joint return and separate returns (using the filing status of married.

If you were married as of December 31, in the tax year you may choose to file a separate return. You may file a separate return, even if you and your spouse. You got this—all you have to do is start! · File your taxes separately from your spouse · Pay more than half of the household expenses · Not have lived with your. This is an alternative to filing jointly. If you file separately and take itemized deductions (instead of the standard deduction), then both spouses have to. You may choose to file separately as an injured spouse only until the extended due date of the return. Once you choose a filing status, the decision is. Though most married couples file joint tax returns, filing separately may be better in certain situations. · Couples can benefit from filing separately if. In addition, a number of credits will be limited or unavailable to you if you file using the married filing separate status. For more information, see the. If you filed jointly (for assume you meant taxes), then that is the only AGI information your servicer has to calculate your payment, so. You may choose to file separately as an injured spouse only until the extended due date of the return, and once you choose a filing status the decision is. If you file separately, you will lose some of the tax benefits afforded to married couples filing jointly. This will typically result in a. What Does "Married Filing Separately" Mean? If you're married, you always have the option to file your taxes separately. If one of you won't agree to file a. If you filed jointly (for assume you meant taxes), then that is the only AGI information your servicer has to calculate your payment, so. Filing Status 3 - Married, Filing a Separate Return: If you and your spouse filed separate federal returns, you may use this filing status. If you and your. Complete a federal return “as if” you were filing separately. DO NOT file the “as if” return with the IRS. Use this return ONLY to complete these special. Status 3. Married Filing Separately Check filing status 3 if you and your spouse filed separate federal tax returns. Use the same filing status as your. If you file separately, you and your spouse will have access to fewer tax benefits. This leads to your combined tax liability on separate returns to generally. married to each other in the year of the loss. If you have a loss from before your marriage, you can apply the loss against only your income (as figured. However, for a married couple filing a joint federal income tax return, if married filing separately may be claimed on the North Carolina income tax return. permits married taxpayers to gain the benefits of separate filing on one return. If separate returns have been filed by both spouses for the taxable year. If you are married, you and your spouse may file a joint return, Choose Filing Status 5 (Married Filing Separate Returns) to file a separate. In the US you can either file jointly or separately, even if you are married for that entire year. In general there is no significant difference.

Ira Withdrawal For Education

I understand that if I need the money for higher education I can move it out of my IRA without having to pay the 10% penalty. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state. Simply report the early-distribution amount from the IRA used for college expenses on Form Enter the amount on Line 2 and enter exception number “ Any money taken from a retirement plan is generally subject to a 10% early withdrawal penalty (unless certain conditions are met). How are IRA withdrawals taxed. Traditional IRA · Savings grow tax deferred · Investments include stocks, bonds, mutual funds, Exchange-Traded Funds, CDs, and so forth · Withdrawals may begin at. Before age 59½, the IRS considers your withdrawal (also called a "distribution") from these IRA types as an early withdrawal, triggering a possible tax penalty. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. You can also borrow from your (k). I understand that if I need the money for higher education I can move it out of my IRA without having to pay the 10% penalty. The amounts withdrawn aren't more than your, your spouse's, your child's and/or your grandchild's qualified higher-education expenses paid during Your. I understand that if I need the money for higher education I can move it out of my IRA without having to pay the 10% penalty. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state. Simply report the early-distribution amount from the IRA used for college expenses on Form Enter the amount on Line 2 and enter exception number “ Any money taken from a retirement plan is generally subject to a 10% early withdrawal penalty (unless certain conditions are met). How are IRA withdrawals taxed. Traditional IRA · Savings grow tax deferred · Investments include stocks, bonds, mutual funds, Exchange-Traded Funds, CDs, and so forth · Withdrawals may begin at. Before age 59½, the IRS considers your withdrawal (also called a "distribution") from these IRA types as an early withdrawal, triggering a possible tax penalty. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. You can also borrow from your (k). I understand that if I need the money for higher education I can move it out of my IRA without having to pay the 10% penalty. The amounts withdrawn aren't more than your, your spouse's, your child's and/or your grandchild's qualified higher-education expenses paid during Your.

If you are withdrawing from a Traditional IRA, the withdrawal amount will be counted as taxable income the year you withdraw. But be aware that withdrawing. Using IRA Withdrawals for College Costs · You may withdraw from an IRA to pay higher education expenses for yourself, your spouse, your child, or your grandchild. The best approach is to use a Roth IRA to pull out without a 10% early withdrawal penalty. You can roll a (k) into an IRA to pay for educational expenses. How to avoid the 10% additional tax on early IRA distributions when they are used to pay for qualified educational expenses; illustrated with examples. Retirement funds may help your pay for college expenses. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. Distributions from an IRC Section College Career and Savings Program Account not used for qualified educational expenses are taxable and reportable as. In addition, qualified education expenses can be used to justify only one education tax benefit. If these expenses are used to justify a penalty-free withdrawal. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. With a Roth IRA, contributions are not tax-deductible, but earnings can grow tax-free, and qualified withdrawals are tax- and penalty-free. Roth IRA withdrawal. Qualified education expenses are an exception to the early withdrawal penalty. If you use a Roth IRA withdrawal for qualified education expenses, you will avoid. Students can withdraw funds early with no penalties to pay for qualified higher education expenses, like tuition and supplies. The Roth IRA withdrawals, however, will not attract any income tax. But, there are rules to follow here, as well. In order to draw tax free earnings from a Roth. To qualify for the penalty exemption for education expenses, you must have qualifying college expenses in the year when you take a distribution. If you plan to. You can take a distribution from your IRA before you reach age 59 1/2 and not have to pay the 10% additional tax if, for the year of the distribution, you pay. To qualify for the penalty exemption for education expenses, you must have qualifying college expenses in the year when you take a distribution. If you plan to. If you are not yet 59 ½ years old, k withdrawals are also subject to a 10% early withdrawal penalty. While IRAs offer an exception to the early withdrawal. An education IRA is an individual savings account used for education expenses and offers tax advantages. It was first implemented into law in the United States. Students can withdraw funds early with no penalties to pay for qualified higher education expenses, like tuition and supplies. Withdrawal rules vary, depending on whether you have a traditional or Roth IRA and, generally, your age. While you must be 59½ to withdraw funds from a.