xoat.ru

Prices

Best Credit Cards For Low 600 Score

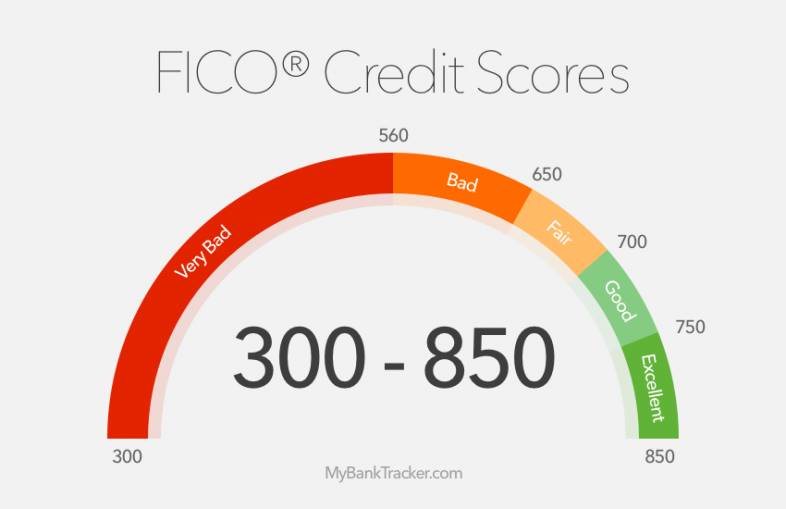

A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. With a higher credit score and lower DTI ratio, you improve your chances of qualifying for a home loan. Don't close credit card accounts. Credit scores are also. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®. There is anecdotal evidence of applicants with scores as low as the mids being approved, but that's rare. Even for the American Express® Green Card, a more. The Capital One Platinum Credit Cardis a no-frills credit card for those on the lower end of the average credit score range, who are mostly interested in either. As one of the largest direct home mortgage lenders in the country, Wells Fargo Home Mortgage has programs to help even borrowers with low credit scores. Some of. Yes $20/month for daily Experian FICO scores and reports and monthly EQ and TU scores and reports. xoat.ru is $40/mo for the premium package. Credit cards for fair/average scores · Credit One Bank® Platinum Visa® for Rebuilding Credit · Credit One Bank® Platinum Visa® for Rebuilding Credit · Rewards rate. We've done the research and come up with a list of the best credit cards for a FICO score: Capital One Platinum Mastercard review - Best unsecured credit. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. With a higher credit score and lower DTI ratio, you improve your chances of qualifying for a home loan. Don't close credit card accounts. Credit scores are also. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®. There is anecdotal evidence of applicants with scores as low as the mids being approved, but that's rare. Even for the American Express® Green Card, a more. The Capital One Platinum Credit Cardis a no-frills credit card for those on the lower end of the average credit score range, who are mostly interested in either. As one of the largest direct home mortgage lenders in the country, Wells Fargo Home Mortgage has programs to help even borrowers with low credit scores. Some of. Yes $20/month for daily Experian FICO scores and reports and monthly EQ and TU scores and reports. xoat.ru is $40/mo for the premium package. Credit cards for fair/average scores · Credit One Bank® Platinum Visa® for Rebuilding Credit · Credit One Bank® Platinum Visa® for Rebuilding Credit · Rewards rate. We've done the research and come up with a list of the best credit cards for a FICO score: Capital One Platinum Mastercard review - Best unsecured credit.

Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. IHG One Rewards Traveler Credit Card: Best feature: Bonus points at IHG hotels. Delta. Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Cards Choose from these Bank of America® credit cards to find the best fit. "Good" credit includes scores of or above, and "poor" credit includes scores of around and below. credit cards only require a good or fair credit. It is geared to consumers having good to excellent credit scores, with an average score of among cardholders. However, scores in the fair range, as low as. One of the best credit cards you can get for a credit score is the Capital One Quicksilver Secured Cash Rewards Credit Card. This card comes with. PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. The Capital One Platinum Secured Credit Card may be a good option for those rebuilding credit. And as you explore your credit card options, consider getting pre. Southwest Rapid Rewards® Premier Credit Card · Rewards · Welcome bonus · Annual fee · Intro APR · Regular APR · Balance transfer fee · Foreign transaction fees · Credit. Find the Best Credit Card for You. Double Your Line® Credit Card. No Security Monthly FICO® Score for free. FAQ tick Zero liability for unauthorized. Platinum Mastercard® from Capital One The Platinum Mastercard® from Capital One is an unsecured card you can get with a credit score that charges no. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. With 15+ years of experience reporting on credit cards, we've selected the Capital One QuicksilverOne Cash Rewards Credit Card as the best credit card for fair. Find Visa credit cards with low interest rates, rewards offers More card details. Recommended credit score. Excellent; Good. Visa Signature®. Visa Infinite®. The top credit cards for bad credit help you rebuild your credit. Whether you pick a secured or unsecured card, options like the Citi® Secured Mastercard® &. The Discover it® Secured Credit Card is our best credit card for bad credit because it earns cash rewards with a $0 annual fee and helps build your credit. With a credit score, you might be able to get a traditional credit card. While most credit card issuers don't publish minimum credit scoring standards, some. In general, a credit score ranging from to is considered poor, but this varies based on the scoring system. Here's a closer look at the FICO Score and. Here's a Summary of the Best Unsecured Credit Cards for Bad Credit of May ; Prosper® Card · Best for users with low credit. Bad/Poor. Snapshot of Card Features · Up To $1, credit limit doubles up to $2,! · See if you Pre-Qualify with no impact to your credit score · Monthly reporting to the.

What Is Startengine

StartEngine Crowdfunding is an equity crowdfunding platform headquartered in Los Angeles, California that allows people to invest and own shares in startups. Start Engine is like a Kickstarter for startups. You buy a small share of the startup and if they go public, you have the opportunity to make a return on your. StartEngine is an equity crowdfunding platform that allows everyday people to invest and own shares in startups and early-stage companies. Your Investment Account is what will allow you to hold funds and trade on StartEngine Secondary. We require all users to open an. StartEngine is an equity crowdfunding platform that allows people to invest and own shares in startups and early growth companies. Do you agree with StartEngine's 4-star rating? Check out what people have written so far, and share your own experience. StartEngine is an equity crowdfunding platform that connects entrepreneurs with potential investors, allowing them to raise capital for their businesses. StartEngine Crowdfunding is an equity crowdfunding platform headquartered in Los Angeles, California that allows people to invest and own shares in startups. Founded in , StartEngine is an equity crowdfunding and security token offering platform that seeks to help entrepreneurs achieve their dreams by. StartEngine Crowdfunding is an equity crowdfunding platform headquartered in Los Angeles, California that allows people to invest and own shares in startups. Start Engine is like a Kickstarter for startups. You buy a small share of the startup and if they go public, you have the opportunity to make a return on your. StartEngine is an equity crowdfunding platform that allows everyday people to invest and own shares in startups and early-stage companies. Your Investment Account is what will allow you to hold funds and trade on StartEngine Secondary. We require all users to open an. StartEngine is an equity crowdfunding platform that allows people to invest and own shares in startups and early growth companies. Do you agree with StartEngine's 4-star rating? Check out what people have written so far, and share your own experience. StartEngine is an equity crowdfunding platform that connects entrepreneurs with potential investors, allowing them to raise capital for their businesses. StartEngine Crowdfunding is an equity crowdfunding platform headquartered in Los Angeles, California that allows people to invest and own shares in startups. Founded in , StartEngine is an equity crowdfunding and security token offering platform that seeks to help entrepreneurs achieve their dreams by.

The Concept Behind StartEngine. Via the StartEngine platform, non-accredited investors are presented with an opportunity to invest as little as $ in startups. This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. This investment is speculative, illiquid, and involves a high degree of risk. StartEngine is one of the leading equity crowdfunding platforms in the U.S., where everyday people can find and invest in early-growth companies and. StartEngine is an equity crowdfunding platform that allows everyday people to invest and own shares in startups and early-stage companies. Start Engine is like a Kickstarter for startups. You buy a small share of the startup and if they go public, you have the opportunity to make a return on your. StartEngine is the leading equity crowdfunding platform in the U.S., connecting everyday investors with tomorrow's progressive companies. StartEngine is one of the top funding portals in the crowdfunding space. They're a private company, but through their secondary market investors can buy and. StartEngine gives you access to our amazing community of engaged and enthusiastic investors and founders. You will be able to see what other investors are. StartEngine has a rating of stars from reviews, indicating that most customers are generally dissatisfied with their purchases. Discover 5 of the most promising companies currently raising capital on the crowdfunding platform, StartEngine. StartEngine is an equity crowdfunding platform that allows people to invest and own shares in startups and early growth companies. Find the latest StartEngine Crowdfunding, Inc. (STGC) stock quote, history, news and other vital information to help you with your stock trading and. Find the latest StartEngine Crowdfunding, Inc. (STGC) stock quote, history, news and other vital information to help you with your stock trading and. Get Startengine Crowdfunding Inc (STGC:OTCPK) real-time stock quotes, news, price and financial information from CNBC. StartEngine is an equity crowdfunding platform that enables individuals to invest in and own shares of startups and early-stage businesses. Invest in companies to start building your startup portfolio. Monitor your portfolio dashboard to track all your investments in one place. StartEngine gives. STGC | Complete StartEngine Crowdfunding Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. On StartEngine, everyday people can invest and buy shares in startups and early stage companies. StartEngine is a popular equity crowdfunding platform connecting all types of startups with investors. • From $ to $1, is the minimum span here. However. StartEngine just inked an exclusive deal with Indiegogo to enable founders the opportunity to raise capital from the crowd for their businesses' full life.

Best Reit Stocks For Dividends

Top real estate companies by dividend yield ; favorite icon, 1. SM Prime Holdings logo. SM Prime Holdings. 1SPHXF ; favorite icon, 2. Office Properties Income. This is the current annual yield of the investment. Usually, the yield of a REIT will be higher than other dividend paying stocks, as a REIT needs to distribute. stocks in my income portfolio. Can't get excited about $WY % Div. My strategy is fat % Div for my Income Portfolio and high growth stocks. Selecting the stocks with the highest dividend yields from its parent index, the FTSE All-World index (excluding REITs), the FTSE All-World High Dividend. Our research team runs the industry's toughest dividend screening test and only picks from the top 5%. Top Reit Stocks ; Nexus Select Trust, , ; Embassy Office Parks REIT, , ; Brookfield India Real Estate Trust REIT, , This high dividend payout requirement means a larger share of REIT investment returns come from dividends when compared with other stocks. best experience on. (NYSE: SPG) and Equity Residential (NYSE: EQR). Why not invest in REITs? REIT values are highly tied to the real estate market's performance. The REIT must also pay out 90% of its annual taxable income in dividends. Due to this structure, they typically pay out a higher rate of dividends than equities. Top real estate companies by dividend yield ; favorite icon, 1. SM Prime Holdings logo. SM Prime Holdings. 1SPHXF ; favorite icon, 2. Office Properties Income. This is the current annual yield of the investment. Usually, the yield of a REIT will be higher than other dividend paying stocks, as a REIT needs to distribute. stocks in my income portfolio. Can't get excited about $WY % Div. My strategy is fat % Div for my Income Portfolio and high growth stocks. Selecting the stocks with the highest dividend yields from its parent index, the FTSE All-World index (excluding REITs), the FTSE All-World High Dividend. Our research team runs the industry's toughest dividend screening test and only picks from the top 5%. Top Reit Stocks ; Nexus Select Trust, , ; Embassy Office Parks REIT, , ; Brookfield India Real Estate Trust REIT, , This high dividend payout requirement means a larger share of REIT investment returns come from dividends when compared with other stocks. best experience on. (NYSE: SPG) and Equity Residential (NYSE: EQR). Why not invest in REITs? REIT values are highly tied to the real estate market's performance. The REIT must also pay out 90% of its annual taxable income in dividends. Due to this structure, they typically pay out a higher rate of dividends than equities.

The iShares Cohen & Steers REIT ETF prioritizes real estate investment trusts with large market caps. The fund has generated an annualized return of % over. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Author "NY Stock Exchange's Best High Dividend Note that REIT dividends are taxed differently (ordinary income rate) than stocks. Similarly, it would prove beneficial to factor in a REIT's growth in EPS and current dividend income before investing to maximise returns. Also Explore. Top. Mortgage REIT Stocks FAQ · Granite Point Mortgage Trust (NYSE:GPMT) has an annual dividend yield of %, which is 11 percentage points higher than the. Top real estate dividend stocks ; Blackstone Group, (NYSE:BX), $ billion ; Federal Realty Investment Trust, (NYSE:FRT), $ billion ; Essex Property Trust, . REITs ; 7 Low-Risk Dividend Stocks to Buy · Glenn Fydenkevez · Aaron Davis ; 8 Best High-Yield REITs to Buy · Tony Dong · Tim Smart ; 7 Best Funds to Hold in a Roth. All companies with high dividend yields (above 5%) should be researched for sustainability. For more options please click on 'Advanced Filters'. Discover Top. Monthly Dividend Stock #5: EPR Properties (EPR); Monthly Dividend Stock #4: U.S. Global Investors (GROW); Monthly Dividend Stock #3: Apple Hospitality REIT . Top Reit Stocks ; Nexus Select Trust, , ; Embassy Office Parks REIT, , ; Brookfield India Real Estate Trust REIT, , REITs typically pay higher dividends than common equities. REITs are able to generate higher yields due in part to the favorable tax structure. These trusts own. A main reason for the outperformance of REITs vs the S&P is that all reits must pay 90% of their income as dividends. History shows that the. How have REITs performed in the past? REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock. Average annual returns include changes in price and reinvestments of dividends Investment style risk: The chance that the returns from REIT stocks—which. Real Estate Investment Trusts Pay High Dividends. REITs typically pay high dividends compared to the stock market. REITs yield about % annually, while. REIT investing (real estate investment trust) is a great way for investors to profit from realty income dividends without having to buy or manage property. They trade on stock exchanges, offering investors a chance to earn steady dividends and potential capital appreciation without the hassle of directly managing. Apple Hospitality REIT, Inc. (APLE): A Good Stock That Pay Dividends Monthly. Published on September 1, at pm by Vardah Gill in News. Dividend Yield ETF (Ticker: RIET) invests in select high dividend yielding real estate Preferred stocks may decline in price, fail to pay dividends, or be. Average annual returns include changes in price and reinvestments of dividends Investment style risk: The chance that the returns from REIT stocks—which.